5 Ophthalmology Billing Tips You Can’t Afford to Miss

You already know that getting claims paid is an important part of the financial health of your practice. Unpaid claims are a huge drain on your bottom line. These easy tips will help ensure that your claims are paid quickly. #1 Collect the CORRECT Insurance Information It seems overly simple: incorrect insurance information means claims… Read More

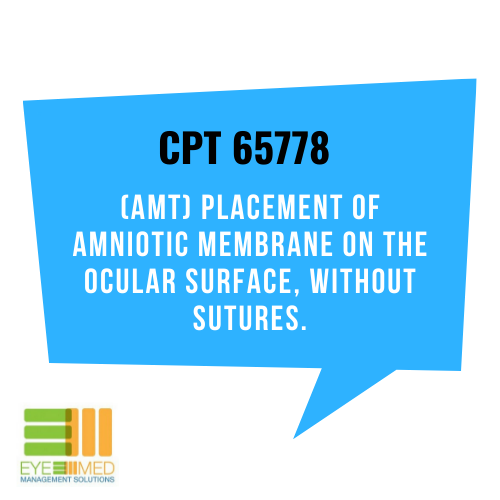

BILLING BASICS: CPT 65778

Do you bill for CPT 65778 in your practice? Keep reading. Definition: The amniotic membrane comprises the innermost layer of the placenta. Amniotic membrane transplantation (AMT) has been used in many different types of reconstructive surgery. There is no global period for CPT 65778. Reimbursement is signifcantly less if done in the ASC… Read More

5 REASONS TO OUTSOURCE BILLING AND REAP THE REWARDS

The benefits of outsourcing your ophthalmology billing could transform the financial health of your practice. With the right billing partner, you’ll see increased revenue and an A/R that’s in tip-top shape. Thinking about outsourcing? These five reasons explain how your practice can reap the rewards. #1 You’ll Get Paid Quickly A healthy cash flow leads… Read More

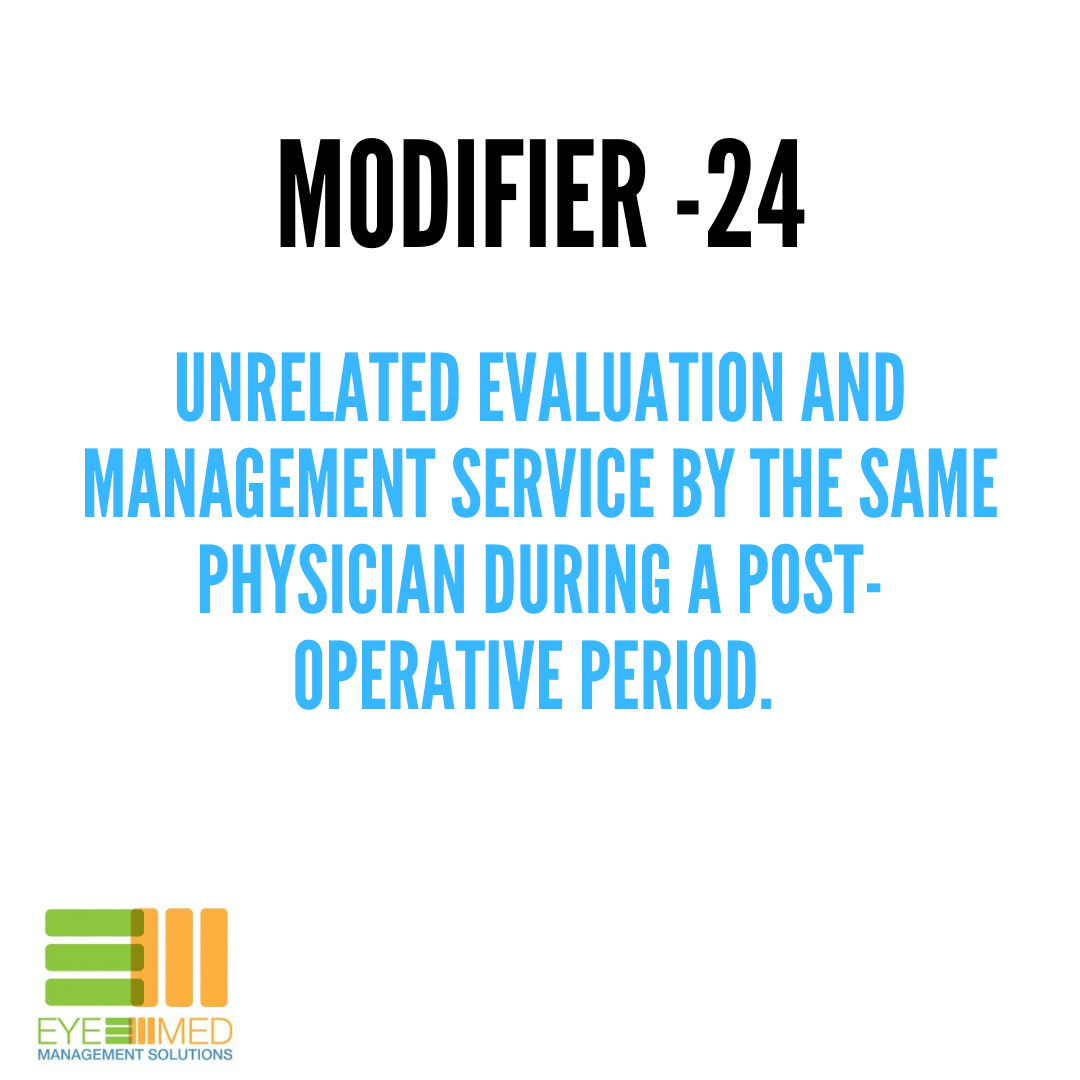

BILLING BASICS: MODIFIER 24

Modifier 24 is defined as an unrelated evaluation and management service by the same physician or other qualified health care professional during a post-operative period. Medicare defines same physician as physicians in the same group practice who are of the same specialty. For example, a patient had cataract surgery on the right eye in August… Read More

3 SIMPLE TIPS TO GET INSURANCE CLAIMS PAID

Unpaid claims are a huge drain on your bottom line. And nobody wants to miss out on money earned. Follow these simple tips to keep your rejected and denied claims ratio in the healthy range. [See related post: 5 Billing Vital Signs You Should Be Checking] #1 Collect and Check Patient Insurance If there’s only… Read More

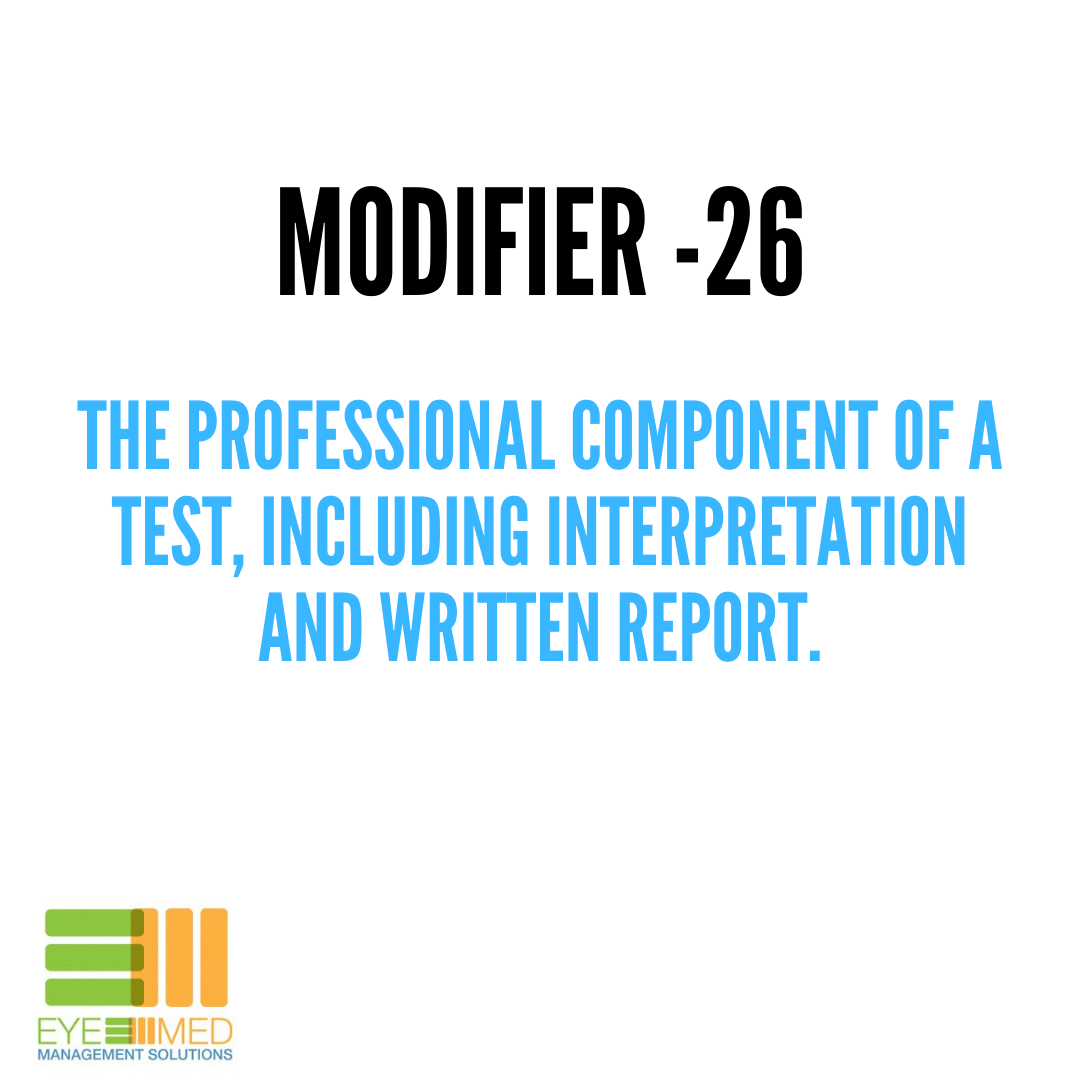

BILLING BASICS: MODIFIERS -26 AND -TC

Modifier 26 The professional component of certain procedures and includes the interpretation of results and written reports. Using modifier -26 identifies the professional component. Modifier TC The technical component of certain procedures and includes the supply of the equipment, supplies, staff, and costs associated with performing the procedure. A great example of using these modifiers… Read More

5 THINGS WE LIKE ABOUT ADVANCEDMD PRACTICE MANAGEMENT SOFTWARE

This is the first in a 3-part series of our favorite practice management softwares. Practice management software can help you save time, reduce errors, and stay compliant. Plus, any chance you have to automate or optimize can also positively impact your bottom line. In our many years of working with ophthalmology practices, Eye Med Management… Read More

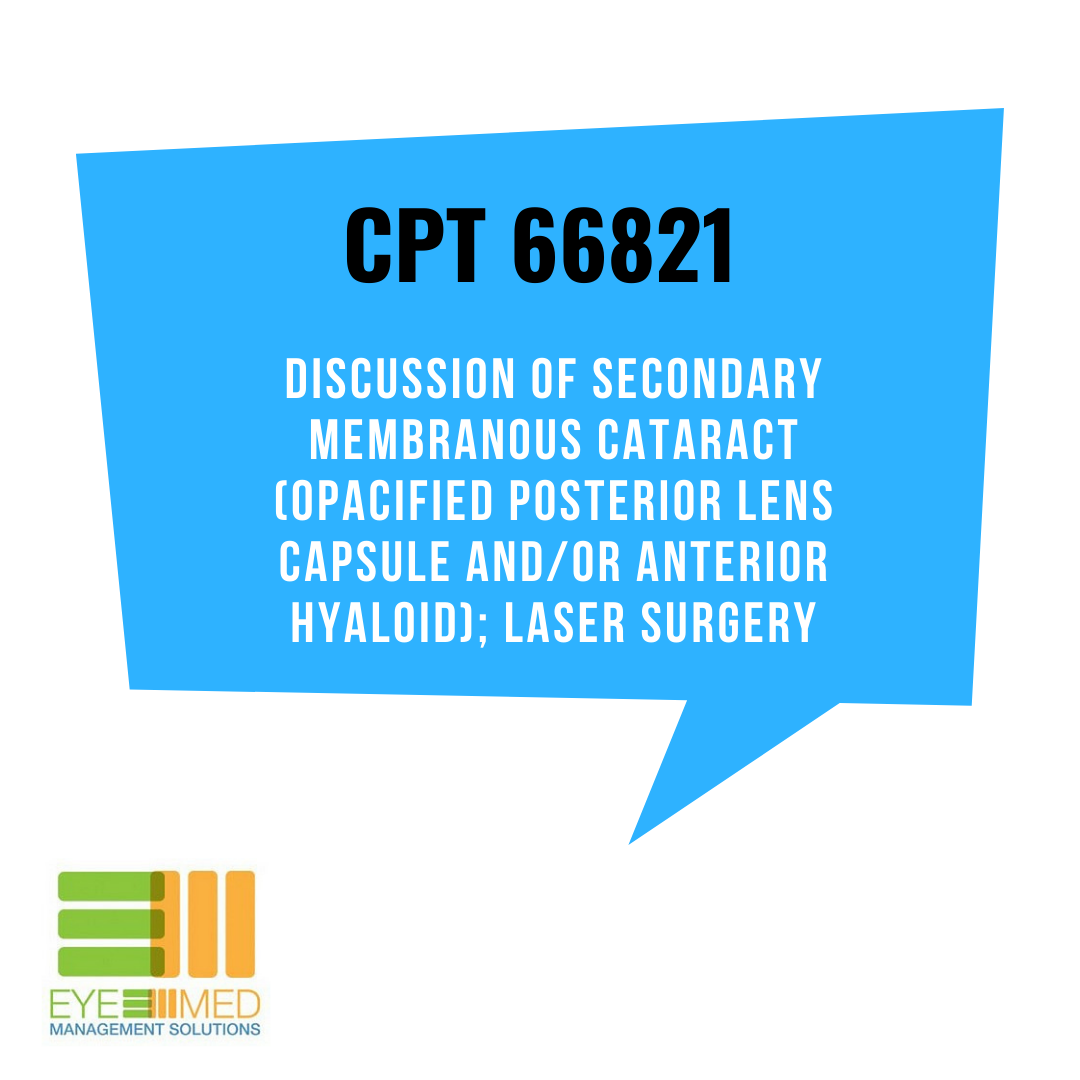

5 THINGS YOU NEED TO KNOW ABOUT BILLING CPT 66821

DOES YOUR OPHTHALMOLOGY PRACTICE BILL FOR YAG’S? BELOW ARE TIPS TO GET YOUR CLAIMS PAID TIMELY. #1 Payment is per eye. Use modifier -50 if the procedure is done bilaterally. Use modifiers -RT or -LT if the procedure was performed on only one eye. Use modifier -78 if the procedure was performed within 90 days… Read More

EVERYTHING YOU NEED TO KNOW ABOUT MODIFIER -25

We’re sure the question, “what modifier do I use?”, has popped into your head many times when a patient comes into the office for punctum plugs, an epilation, or an injection. If you’re billing an exam with a minor procedure that has a zero or 10 day global period, modifier -25 is required on the… Read More

6 TIPS FOR BILLING PLUGS, CPT 68761

Does your ophthalmology practice bill for punctum plugs? Below are six tips to get your claims paid timely. #1 Documentation requirements prior to punctal plugs include: 1) patient’s unique complaint (not cloned), chart documentation should describe the patient complaint as dry, burning, itching and/or excessive tearing, 2) what methods for relief have been tried and… Read More